Flyin' Fancy for Peanuts: Travel Hacks That'll Make You Feel Like A Star.

Traveling in style doesn't have to be reserved for the rich and famous. Over the last three months, my partner Brian and I have jet-setted around the world in business class, flying from Vancouver to Lisbon, Dublin to Nanaimo, and Vancouver to Auckland for a grand total of $361.72. If you're wondering how we managed this, the answer lies in credit card point hacks. In this post, I will share the secrets to our success and teach you how to leverage your credit card rewards to be a bit more comfortable on your next trip.

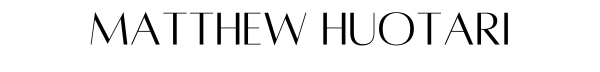

Picture This: Breeze through security and head to the Air Canada Signature Suite for a chef-prepared meal and a glass of bubbly. Enjoy a warm shower before your 12-hour flight, then experience priority boarding, top-notch service, and a delicious multi-course in-flight dining experience. Imagine sleeping soundly for 8 hours on a lay-flat bed during a 14-hour flight – no jet lag and no lost time!

Our Great Point Heist:

Here's a quick rundown of the flights we've snagged lately using credit card points and E-upgrade credits:

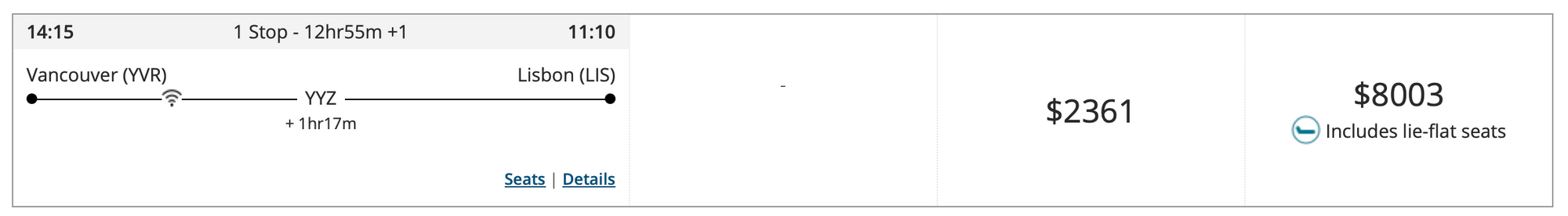

December 2022: Vancouver to Lisbon: 70,600 points each + 11 E-upgrade credits each. Retail Value: $8,008 each or $16,016 total. We paid $53 in taxes each.

March 2023: Dublin to Nanaimo:: 68,100 points each. Retail value: $4,140 each or $8,280 total. Taxes: $27 each.

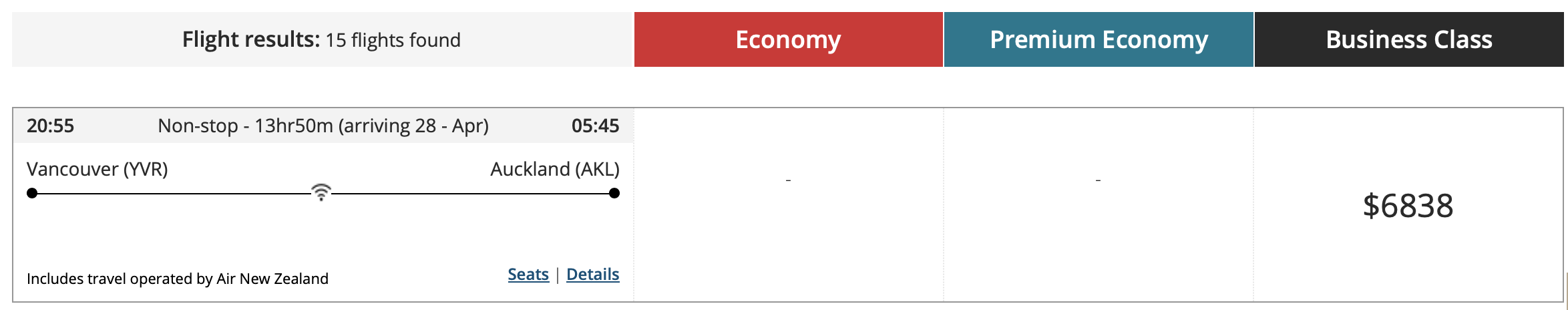

March 2023: Vancouver to Auckland:: 70,900 points each. Retail Value:$6,838 each or $13,676 total. Taxes: $100.86 each.

Total Retail Value: $37,972

Total Points used: 419,200

Total cost to us: $361.72

Total E-upgrade credits used: 22

All of these flights were booked through Air Canada on my TD Aeroplan Infinite Credit Card.

Now, I'm no travel guru, but using credit card point hacks has allowed us to live like royalty in the skies, without the royal price tag. We both agreed we would never pay retail value for these flights.. I definitely do not sell enough pizzas to pay for these flights right now. But, we will definitely keep maximizing the credit card points to make our travel experiences better and cheaper.

Mastering the Art of Points-Fu: Credit Card Point Hacks

Here are the secrets to our success:

Pick your credit card like you pick your friends: Be selective! Look for cards that have sweet rewards, sign-up bonuses, and travel perks that make your heart sing.

Here is an example of a current promotion: TD Aeroplan Visa Infinite Privilege Credit Card: Earn up to 115,000 aeroplan points! This is an amazing sign up bonus in my opinion. There are some rules you must follow to get the full points, as with most credit cards, but it is worth it. There is a long list of perks that come along with this credit card that you can read about on their website. Now, the part that will turn most people off is the annual fee. The annual fee for this credit card is $599 per year, but the value of the perks that come along with the card along with the value of 115,000 points is much higher than $599.

You CAN just sign up for the card and then cancel it once you get the bulk of the sign up bonuses so that you don’t pay another year’s fees, or you can keep it forever. If you travel a few times per year, I would say a high credit card fee is worth it for the points you will accumulate and access to the lounges. Lounges always have unlimited free food and alcohol, and are much more peaceful than the general airport areas.

You can see from my examples above the amount of points I spent on those flights to see the values compared to the sign up bonuses. I will say that it does take a long time to research the absolute best flight deals out there. Having flexibility when you are traveling will also help drastically. We sometimes let the best flight deals dictate where our next trips will be.

Choose your favourites: For me personally I stick to only Visa and American Express, and I mostly am loyal to only Aeroplan/ Air Canada. I find these providers have treated me exceptionally well. For hotels I mostly use Marriot Bonvoy with the Amex Bonvoy credit card.

E-Upgrade Credits: Specifically with Aeroplan you also get E-upgrade credits deposited into your account each year which can be used towards upgrading from economy to economy plus or business class. I use these for when the points value for a certain flight is way too high, but I can “bid” for an upgrade on that flight I have booked in economy for a business class seat. Our most recent flight from Vancouver to Lisbon was booked in economy, and I needed to use my E-upgrade credits before the year ended or I would lose them, and a week before the flight I got the email that we had been bumped up to business class trading in those credits.

Chose the best option with the highest value: If the value of the points is worth less than $0.02 per point then I usually just pay cash for the flight. For example with our flight from YVR-AKL I used 70,900 points for the one way flight that retailed $6838 meaning I was getting $0.09 per point in value. Also if you want to just stay away from business class flights you can fly even more frequently or with more people by using your points for economy class flights. For each flight we take I usually just see what kind of value I am getting from my points and only use them for those high value redemptions. If not, I just pay for the flight with cash. (Well I use my TD Aeroplan Visa to get bonus points on Air Canada flights).

When to buy points: Sometimes you can buy points at a discount through Air Canada. Only do this IF you NEED to bump your points over the line to book a flight OR if you are ballin already and want to book business class flights all the time. It’s usually cheaper to buy the points at a discount and then use those points towards the business class flight than just straight up pay cash for the flight.

Your credit card is now your go-to shopping buddy: Pay for everyday expenses with your rewards credit card to rack up points like a boss. Just remember to pay off the balance each month – interest charges are not cool and completely reverses all of this work. Read each specific card's details to see which cards get the most points for certain purchases. For example, I book my flights with my American Express Platinum card. I also book rental cars on it, as a perk to that card is that the card gives you rental car insurance for up to a 45 day rental anywhere in the world. That perk alone is worth the annual fee. I use my TD infinite for groceries as I get more points per dollar spent on groceries with this card. Booking Marriot hotels I use my Amex Bonvoy to maximize those points.

I try to put every single expense I have personally and business wise through my credit cards to maximize the points.

Aeroplan store: If you login to your Air Canada account and then go to the E-store, you can online shop at some of your favorite retailers and get bonus points on those purchases. If you shop on Amazon, right now you can get 7X the points on purchases made on Amazon. Any of my large Apple purchases I have made I always use my Aeroplan E-store to maximize my points. Other retailers are: Bestbuy, The Gap, Lululemon, Sephora, Dyson, and hundreds more.

Be on the lookout for promotions: Credit card companies love to throw in some extra goodies every now and then. Keep an eye on your emails and account notifications for those sweet, sweet bonus opportunities.

Points-pooling party: Combine points from different sources, like your partner's credit card or loyalty programs. More points, more fun! Occasionally there is a promotion to transfer your points from one account to another at a premium. For example, I was once able to transfer my Amex points to Air Canada at 1.2 points per point premium. I transferred 100,000 Amex points for 120,000 Aeroplan points. I usually pool my points in Amex until I need to transfer them. Occasionally there are good deals to book directly through Amex travel.

Take things to the next level when you have a loved one or businesses that can take advantage of this system. There is nothing stopping you from having a new credit card every 6 months. There is a small hit on your credit score each time you sign up for a new card, so if you plan to buy a house or something in that period, I wouldn’t sign up for a new credit card. If you know that you have huge expenses coming up that can be tossed on a credit card, that’s a great time to sign up for a new card or two because you will be able to hit those spending requirements right away and get them points faster! Just monitor your credit score to make sure your not causing it harm by overusing this system.

Get cozy with your loyalty program: Take the time to learn the ins and outs of your credit card's loyalty program. Knowing the rules will help you squeeze the most value out of your points and E-upgrade credits. I follow multiple bloggers that talk about all of the credit card hacks out there. Here are my favourites: Prince of Travel, Canada Points Guy, and Rewards Canada. There is lots of great content out there on this subject.

Be careful: If you have a hard time paying off credit cards and having zero balances or having access to lots of credit then I would suggest you stay away from more credit cards. Once you have that under control then you can start signing up for new cards.

Here’s a list of all of the cards I have and have had in the past:

American Express Platinum: I will always have this card even with its huge annual fee. It yields great points, has travel insurance benefits, worldwide access to hundreds of airport lounges, front of the line concert tickets, annual $200 travel credit to be used on any sort of travel expense, free Uber One, NEXUS fee is waived, automatic status upgrade with Marriot Bonvoy and Hilton Honors, 24 hour concierge service, purchase protection on everything bought on the card (Say for example you buy a new Macbook pro on your Amex Platinum and it gets stolen or broken within the first month of ownership, Amex will buy you a new one). There is a very long list of perks that come along with this card. It's also made of solid steel, so it’s kinda badass as well. Maybe that’s pretentious? You be the judge.

American Express Aeroplan Reserve: I got this one for the huge sign up bonus and since it comes with most of the perks the Platinum has, I might cancel it before my year is up. I put into my phone calendar when my credit cards are up for renewal and decide if I want to cancel or keep. Sometimes when you call the company they will throw you some bonus points to keep the card as well.

American Express Bonvoy: I have this card to get all of the perks of booking with Marriot Hotels. It has a small annual fee as well that I don’t mind paying for the perks. I have a higher status with Bonvoy which usually grants me 2pm checkouts, early check-ins, free breakfast or free wifi.

TD Aeroplan Infinite Visa: I have had this card for 10+ years and is just my goto card for general expenses with a reasonable annual fee. I won't cancel it just because it has a great long credit history attached to it.

TD Aeroplan Business Visa: I have one of these for each business I own. They usually come with huge sign up bonuses and low annual fees.

CIBC Aeroplan Infinite Visa: I really only got this card because it had a decent sign up bonus and I was trying out CIBC as a bank. Three of us bought a house together a couple years back and I wanted the banking for it to be fully separate from my personal banking at TD, so I took advantage of another sign up bonus and testing out a different bank.

American Express Business Platinum: I don’t have this credit card anymore. I signed up for it years ago attached to my holding company to get the sign up bonus, but I found I wasn’t spending any money on it through my hold co, so it didn’t make sense for me to pay the high annual fee. I got the sign up bonus and then left.

With credit card rewards, Brian and I have managed to enjoy some pretty amazing travel experiences without spending a ton of money. If you put in a little time to research and plan, you can also make your next trip way more comfy and memorable without emptying your wallet.